CHFA is a tx agency offering advice about down repayments and almost every other expenses related to to purchase a home

Having your own house may seem for example a hopeless dream, or you could possibly get own your residence and value shedding it – in the two cases, discover applications that will help you having homeownership:

Homeownership Applications

- Advance payment and you may financial apps helps you pick a home.

- The new Part 8 homeownership system helps you which have mortgage repayments towards the a home when you are currently renting using a section 8 homes choice discount.

- Foreclosures guidance apps makes it possible to for individuals who very own your home, but they are worried about dropping at the rear of on your own mortgage repayments.

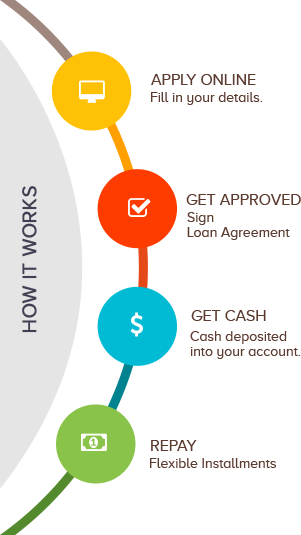

A mortgage is the type of mortgage always pick an effective household and other home. A great homebuyer typically has to come up with 20% or maybe more of selling cost of the home just like the an effective down-payment for the mortgage.

You think that one may never ever cut back adequate having a downpayment into the a property, however, you’ll find software that may help you with your off payment and you may financial which means you won’t need to conserve doing it’s also possible to help pay the cost of repairs or improve to really make the domestic a whole lot more obtainable.

Find out about the downpayment guidance software. CHFA also offers a summary of almost every other down payment advice programs for the Tx.

Homeownership Programs

- Some cities and you may counties bring financial assistance that may reduce your show of advance payment so you can as little as step one% of the cost. The principles are very different for each program. New U.S. Department off Houses and Urban Creativity (HUD) listing homeownership direction applications by Texas urban centers and you will metropolitan areas.

- The new Federal Housing Administration (FHA) even offers mortgage loans with down repayments only 3.5%, low settlement costs, and easy credit qualification.

- Department regarding Pros Situations (VA) Lenders are available having a no advance payment.

- Certain borrowing unions and other loan providers bring no-down-commission mortgage loans.

- Habitat to own Mankind demands only a tiny down-payment, and after that you setup work guarantee hours helping build your own home and/or belongings out of anyone else regarding the homebuilding program; clearing up structure internet sites, in an environment Restore, otherwise creating Habitat work environment performs and other jobs together with be considered. Contact your nearby Environment getting Humanity chapter for more information.

- Your loved ones may be able to help with the downpayment. A cash gift to support a downpayment is desired on most kind of money. New current may https://paydayloansconnecticut.com/bridgewater/ affect the amount of money taxes of the individual offering the bucks, however, you will find constantly no limitations towards number of the newest gift.

Personal Development Accounts (IDAs)

A single Development Account allows you to cut back currency to get a house, pay for advanced schooling, or manage your small business. To open an enthusiastic IDA, you ought to look for an enthusiastic IDA program in your area and you may meet specific qualifications conditions. Once you discover your bank account, brand new recruit of your own IDA system may match the money you put, providing your bank account expand reduced.

The fresh qualifications regulations to have IDA software vary. Basically, you must be doing work, but have reasonable overall income. Once you’re in the latest IDA system, you should as well as need economic knowledge classes that ready yourself your to possess homeownership.

The greatest advantage of an enthusiastic IDA is the fact every time you deposit money into your bank account, the newest sponsors of the IDA program match your deposit with money of one’s own.

A different benefit would be the fact some federally financed IDA programs assist you to keep up money without worrying throughout the house restrictions to own apps such as for example Supplemental Defense Money (SSI).