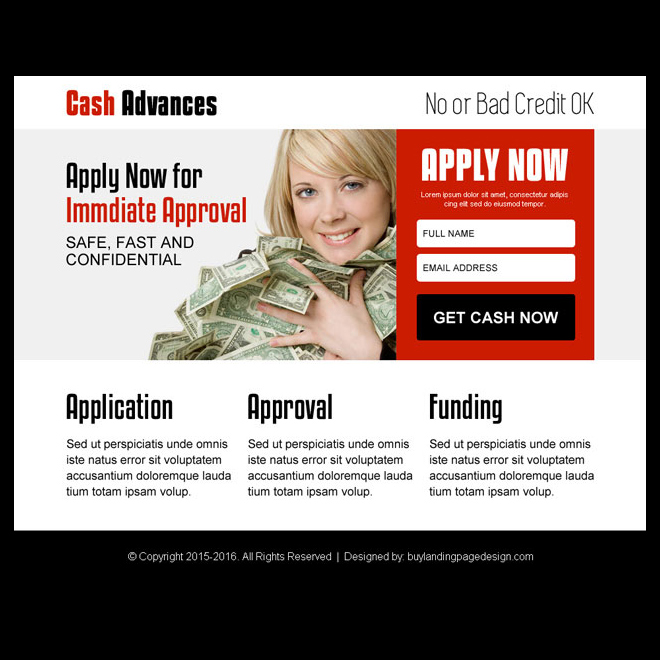

The complete techniques is speeded upwards, enabling really customers discover prompt bucks to own problems

These services is actually mutual for everybody five websites within blog post, allowing someone to keep time and money simultaneouslypleting the online form takes a few minutes, as the currency import happens in incredible a day!

Whenever approved, most of the visitors gets rerouted on the matched up lender website. All five lending systems of your selection works an identical, allowing the clients to carry on dealing with the financial institution couples securely. Whenever connecting to a lender, subscribers hop out the newest financing websites and you will continue functioning on their own.

These financing can be acquired for everybody and you can embraces most of the credit scores

But this is not where process ends. The clients usually takes their some time mention the financial institution they got paired having. Whether your financial appears skeptical or enjoys an adverse profile, the customers is also loose time waiting for almost every other financing also provides.

Subscribers is also read the lender’s web site, see just what they provide, and check loan places On Top Of The World Designated Place their requirements, profile, and recommendations remaining because of the subscribers who’ve caused those people loan providers

Something else entirely that produced all of us continue with the five financing programs is actually the pressure-free loan allowed. None new credit system neither new paired financial duty-bounds the accepted website subscribers to simply accept the mortgage bring. This lets members read and you will comment the mortgage and determine if the the installments satisfy their budget.

In addition to, clients normally see and estimate the eye and costs and you can take into account the more charge that may pertain if the cracking a tip. That it grounds means a lot to us and that’s best for every future individuals which prefer a financing platform out of this article.

We finished up our very own look for the past mutual requirement getting every four other sites – instant 24-hr financial support. It was an extraordinary end of browse as it have a tendency to undoubtedly have more plus prospective clients. These types of platforms make on line credit less and simpler than just conventional bank borrowing from the bank.

Zero event data files, wasting currency waiting on counter, making home or office, etcetera. Quick transferring are several other unbelievable question that produces such programs novel and you can an excellent away from otherspletely, all four mediating functions are worth seeking to since you would not eradicate certainly not rating much.

There isn’t any specific selection of clients who’ll submit an application for a zero credit check financing. What makes it mortgage different from anybody else are the straightforward processes. You ought to confirm your own a career position as well as your constant money versus discussing facts about your credit rating.

Bringing a no credit check mortgage is perfect for men just who need money urgently. The lenders delivering no credit assessment fund usually import the cash for the a day. This type of funds are also also known as exact same-big date money.

Of many loan providers take into account the credit rating of your own candidate when choosing to give him or her a loan. When your borrowing are crappy, they may offer financing but with high attention and you can fees. If for example the borrowing from the bank is good so you can higher level, brand new charges and you will rates are certainly more sensible. On zero credit check loan, the fresh client’s borrowing is not a determining foundation, the the initial thing that produces this mortgage not the same as most other fund.

Another variation try immediate cash transferring. The zero credit assessment financing brands usually are deposited an equivalent time otherwise within 24 hours. And additionally, these financing are in small amounts that will be tend to to $1,100000.

Such loan is sometimes repaid immediately along with your 2nd income or perhaps in multiple installments. Brand new cost day are a month otherwise many years, according to the loan’s amount, earnings count, or other points. Brand new pay day loan normally a type of a no credit assessment mortgage. Which financing are reduced in one otherwise one or two payments, or correctly, on client’s next income.