Santander sees lifetime kept when you look at the You retail lender after exodus regarding Western european peers

Personal loans is actually fund (or lines of credit) provided right to somebody as opposed to passing using a commercial broker/retailer, instead of a certain capital purpose and you can without any obligations out of installing a guarantee. In many cases, to help you expand the financing restriction, the client would be asked an equity, and therefore need not feel necessarily regarding the latest attraction of your finance (we.e. financial make sure, house equity, an such like.).

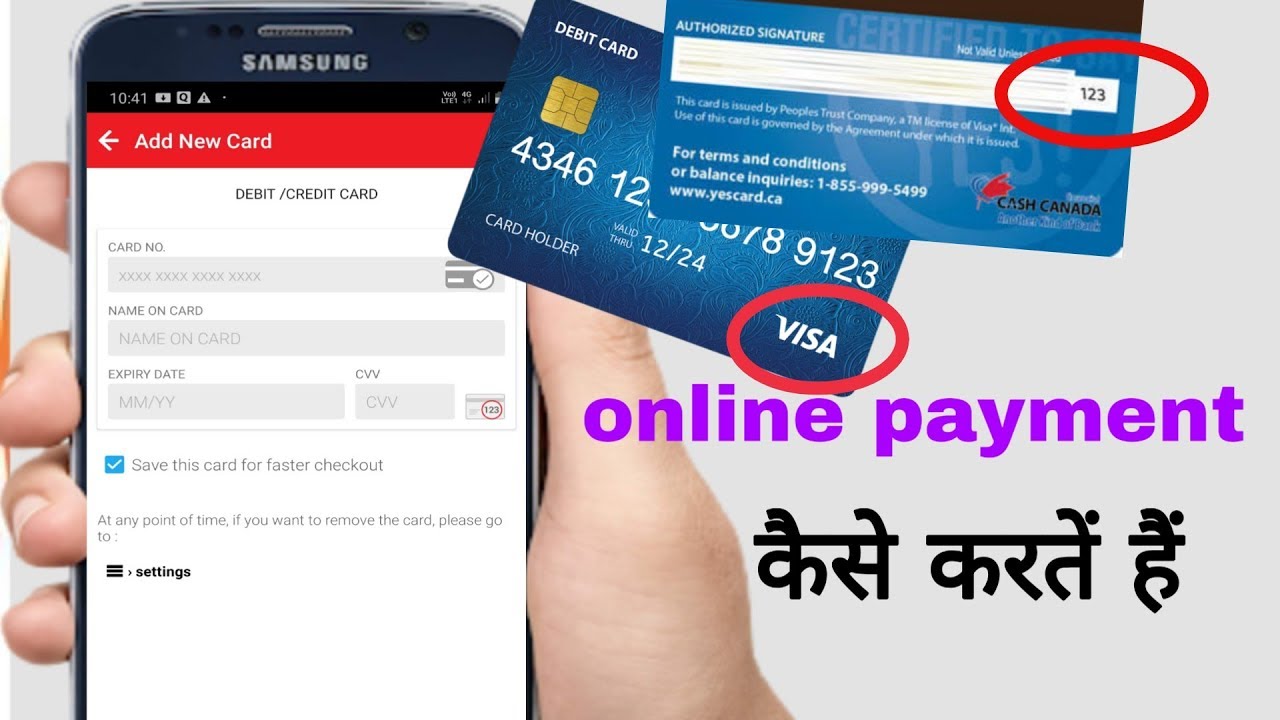

Playing cards

A beneficial universal payment approach (otherwise money withdrawing) issued for the a plastic material ( not fundamentally given the way to obtain digital cards) supplied because of the Lender supplying the owner a solution to use fund doing a beneficial pre-set credit limit. Also includes pre-paid down notes and shop cards applications.

- Publisher Cathal McElroyos

- Motif Health care & PharmaceuticalsReal EstateBankingFintechInsurance

Brand new Foreign-language financial giant have a tendency to story moves to express this new You.S. retail equipment next quarter, suggesting zero instantaneous intends to sign up Banco Bilbao Vizcaya Argentaria SA, HSBC Holdings PLC and BNP Paribas SA within the entirely abandoning new low-margin field. Santander’s You.S. retail bank has don’t blog post a return normally collateral above 5% for more than ten years, according to S&P International Field Cleverness research.

What Santander Lender NA do brag are $80 billon-plus away from places, that have helped to show the fresh new You.S. on Santander’s largest source of payouts by giving lowest-prices resource having vehicles-credit. Brand new merchandising arm, which works 483 twigs as much as Ny, Boston and you can Philadelphia, has throughout the $11 mil out-of auto loans certainly one of the $100 mil-and additionally out of possessions, plus it got its start $8.4 million away from sis product Santander Consumer United states Holdings Inc.’s the reason automobile financing last year.

“He or she is willing to hang onto a mediocre retail franchise just like the it has got cheap resource,” told you Christopher Whalen, a banking analyst and you can chairman of new York-depending Whalen Global Advisors. “You do not simply get rid of $80 million into the center dumps – it’s an asset.”

S. merchandising sector, more than likely since the lender’s barely effective branch network is actually an option money origin for financially rewarding auto loans

This new You.S. auto-credit team generated as much as one fourth regarding complete group profit inside the 2021, considering team filings. The unit produced money regarding $dos.61 mil of $7.55 mil regarding funds in 2021. Santander don’t reveal their get back toward concrete security to own this past year, nevertheless filed a revenue typically security regarding sixteen%, in accordance with the average between 2016 and you can 2020, Industry Intelligence study reveals.

Santander has already improved their contact with the unit by the agreeing to invest in aside minority shareholders to possess $2.5 mil within the . The deal, and therefore cherished loans Grand Junction the firm in the $a dozen.7 billion, can also add 3% for the group’s earnings for every single express in the 2022, Santander told you at that time.

The lending company usually set out preparations to have growing the vehicle providers included in the U.S. means up-date next quarter. It’s going to mention the way it plans to “streamline” retail operations rather than acting as an excellent “full-provider lender,” President Ana Botin said towards the a february telephone call. The bank has chose to stop mortgage and home-collateral loans on You.S., and it may and pare commercial and you may industrial lending, Botin said.

Santander’s long-name objective on the U.S. is to reach a profit into concrete guarantee of more than 15% through the company course, it told you inside an emailed reply to Markets Intelligence’s questions.

The newest U.S. “is a very glamorous business and also the bank’s interest now could be toward partnering our very own retail banking organization and consumer financing adjust profitability next,” the lending company said, noting you to returns just last year had been well above the price of financing.