Within the last while, we seen usually low home loan prices, nevertheless they continues to go up this current year

To buy a property is actually an exciting big date, full of of a lot positive feelings (Don’t lease!) or other anxious thinking (Do we very pay for that it?). Since roller coaster out-of advice can often make one feel exhausted, there was a means to relax. Because of the knowing simply how much household you can afford, possible tour home in your spending budget confidently, and give a wide berth to one client’s remorse later on. This is how to determine what homeloan payment is right for you.

Brand new MHS Va home loan calculator is a fantastic treatment for guess the price section out of property you can afford conveniently. As you might get pre-recognized for $500,000, you might simply be able to swing a $375,000 homeloan payment. Using our very own calculator, you’ll type in where you are, annual earnings, monthly expenses, down payment count, credit rating, projected interest, armed forces types of, and handicap commission.

After that, the latest calculator will reveal just what buck count you really can afford to have property and just what one to payment per month create seem like. Instead of almost every other home loan hand calculators, ours is perfect for people trying to Va fund that is the reason i reason for things like a great Va funding payment. All of our calculator along with teaches you the debt-to-income (DTI) ratio as well as how your own ratio ranks into a scale from affordable to help you high-risk.

Figuring Your DTI

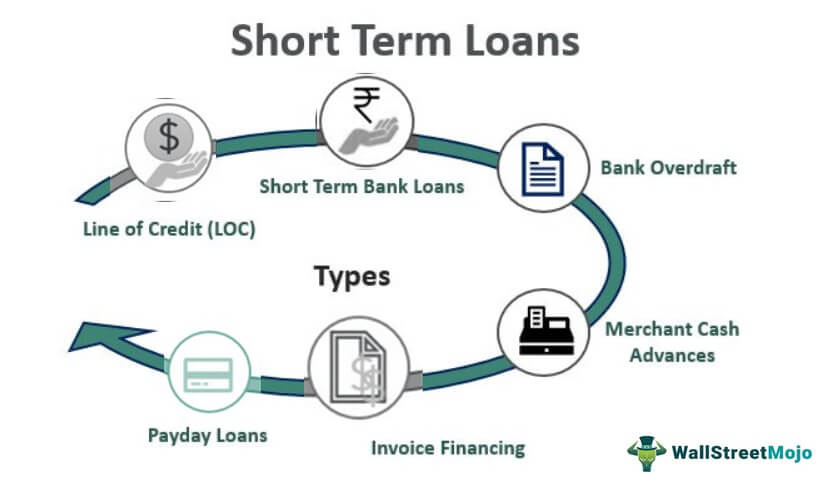

DTI means loans-to-income proportion. This ratio represents exactly how much financial obligation you have rather than the income you will be making. So you’re able to assess the DTI, you’ll split the monthly obligations payments by the month-to-month terrible income. The latest proportion is crucial to know when you need to pick a home whilst says to lenders how good your take control of your obligations and just how likely you are to repay fund.

Like, in the event your monthly loans means $5,000 and your terrible month-to-month income is actually $9,000, your DTI ratio is all about 55% (5,000/nine,000=0.55).

Small mention: Even though the Virtual assistant has no DTI requirements, most banks and you can loan providers will demand an excellent DTI ratio off sixty% or smaller.

This new Rule

If the class in the MHS assesses your own financial application, i assess your debt-to-income (DTI) ratio, just like all of our calculator do. I take-all the monthly continual expense (bank card, vehicle, or unsecured loan repayments) and you may split them by the month-to-month gross income (of paychecks, financial investments, etc.) This proportion allows us to know how even more loans you could reasonably undertake.

Brand new rule can present you with depend on in your economic health by making certain that their mortgage repayment isn’t https://paydayloancolorado.net/hillrose/ any over 30% of your gross monthly earnings and your overall month-to-month obligations are no more than 41% of the total monthly money.

(Dominating + Interest + Assets Taxation + Insurance rates (Homeowners & Mortgage) + Homeowners Association Dues) ? 100/ Gross Month-to-month Earnings

Home loan Rate of interest

Actually quick changes in interest levels change lives for the cost. Taking a look at the $258,000 household from prior to, the borrowed funds changes drastically based on notice alter alone. Such, the fresh new $258,000 house with 5% attract enjoys an effective $1,750 mortgage payment, once the house or apartment with an 8% interest rate keeps good $dos,269 homeloan payment. That is more $five hundred four weeks.

Your own Month-to-month Finances

In the long run, after you’ve put our very own mortgage calculator, determined your DTI, analyzed the new rule, and you can looked over rates, it may be beneficial to do some funds record. Checklist your deals during a period of several months (excluding rent). After you have all of your current purchases, you could sort them towards the buckets-for example, food, activity, medical, relaxation, and more. After that, include their estimated homeloan payment to discover where you stand. Have you got currency left at the conclusion of the times? Normally your current existence manage a mortgage fee? Or even, could you skinny some expenses to suit you to definitely commission?

Short tip: You may need certainly to flow your own projected mortgage repayment for the month-to-month coupons in order to replicate just what it will feel to own a real mortgage payment.

Summation

During the MHS Lending, our company is experts in handling armed forces professionals and you may experts, and therefore, we know the specific particulars of army earnings. Particular Va disability money and you will armed forces allowances like Earliest Allowance to possess Homes (BAH) meet the criteria is measured when deciding how much cash you might use together with your Virtual assistant Loan. BAH try an effective allotment which may be used on purchasing for many away from, if not all, of one’s month-to-month mortgage repayment.

When you find yourself curious when your particular army allotment you get can be used for their Va Loan, call us right here.