ten (Little-Known) A method to Make Riches With your Va Loan Positives

#step 1. Several Va Loans without Virtual assistant Loan Limit

Did you know it’s possible to have multiple Virtual assistant finance? Yep, the simple truth is. Accredited veterans can hold one or more Virtual assistant financing during the an excellent date, which allows with the possession of several properties. And, removing Virtual assistant mortgage constraints to have veterans having full entitlement expands to find power without having to be constrained by the prior state loan limitations. This may helps the purchase from higher-value features otherwise house in more expensive locations.

The new Va loan’s no down-payment requisite notably reduces the latest burden in order to homeownership, which is often step one in the building individual wealth. Additionally, the absence of a significance of home loan insurance coverage reduces monthly costs, as compared to other types of finance, and that enhances affordability and can release money to many other opportunities otherwise deals.

#step 3. Virtual assistant Financing Multiple-Household members Capital Characteristics

Using a great Virtual assistant mortgage to order a multiple-tool property (around four tools), to the stipulation of consuming among units, allows experts to create local rental income about additional gadgets. Which income is also defense the borrowed funds and you can operational costs of the property, probably generating self-confident earnings and this results in money accumulation.

#4. Virtual assistant Mortgage Enough time-Name Leasing Features

On heading out out of good Va-financed domestic, the property shall be leased out. This plan lets veterans to retain attributes and build a profile out of local rental systems, ultimately causing continuous money channels, a key component away from wealth building.

While you are unable to buy an item of home with your Va loan and you can take a seat on it, you can make use of the Virtual assistant loan buying land for many who supply intends to make on the property instantly. You will have to submit certified construction arrangements and you can, through to end, have the complete property checked.

#six. Virtual assistant Renovation Loans

Virtual assistant renovation fund permit pros to invest in both purchase of a property in addition to will set you back of expected renovations on that financing. This will build fixer-uppers a great deal more available and you may affordable, probably raising the value of the property significantly after home improvements.

#7. To order a farm Quarters

Once the Va financing can not be used for buying income-creating facilities, you can use it to shop for a home with the a ranch. This one lets veterans to love rural life style with no monetary weight away from a large downpayment and you may large-attention industrial financing.

#8. Energy-efficient Mortgage loans (EEMs)

Including the expense of energy efficiency improvements to a beneficial Virtual assistant loan can increase the original loan amount but spend less on electricity will set you back in the long run. Which just helps in controlling ongoing expenses as well as expands the value and you will marketability of the house.

#9. Re-finance along with your Virtual assistant Loan

Refinancing options including the Virtual assistant Improve Re-finance (IRRRL) or Va Dollars-Away refinance is straight down rates of interest, treat monthly installments, otherwise promote bucks at home guarantee for use for other investments, debt consolidation, or higher expenses.

#10. Assumable Virtual assistant Funds

Sure, Virtual assistant finance is actually assumable. Assumability off Va money is going to be an appealing function when you look at the a ascending interest rate ecosystem, while making a house more appealing to help you audience who’ll grab more than a lesser interest than just on the market in the business.

Completion & Wrap-Upwards

To conclude, Virtual assistant finance render another type of and effective group of masters that stretch far beyond the fundamental advantage of to invest in property instead an advance payment.

The tiny-understood steps in depth on this page-ranging from possessing multiple qualities, investing multi-loved ones equipment, making use of restoration fund, and you can leverage refinancing possibilities-teach how veterans is also somewhat improve their monetary balance and create generational riches from the Va financing program.

Happy to Unlock the power of Your own Va Financing Benefits? We could Assist!

If you want to pick or re-finance your house for less, to incorporate innovative how to use their Virtual assistant mortgage positives, you can get in contact with you Here.

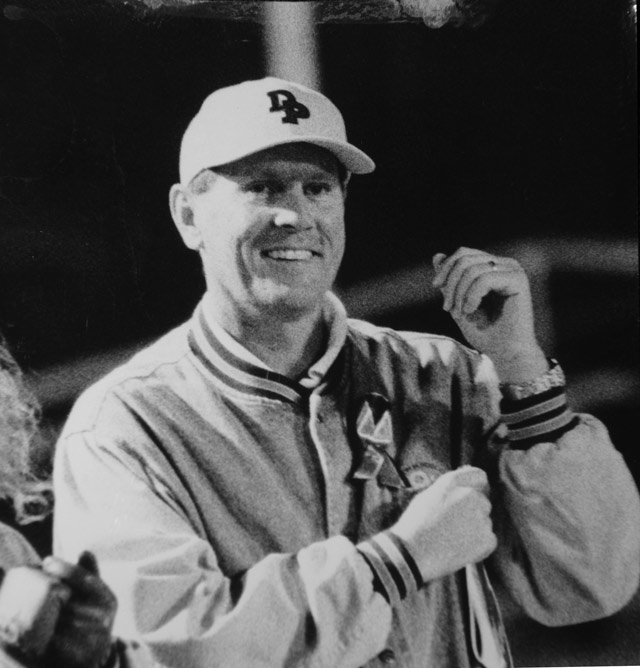

Concerning Publisher

Brian Reese are an older mentor and co-manager during the Region Financing. They are among the many planet’s top experts in veteran experts, that have helped an incredible number of experts secure their financial future because the 2013. Brian is the maker Virtual assistant States Insider, a training-centered Instruction & Contacting company whose mission will be to teach and enable veterans so you’re https://paydayloanalabama.com/section/ able to get the Va disability positives they usually have gained because of their respectable provider. An old active-obligations sky force manager, Brian deployed to help you Afghanistan in support of Procedure Long lasting Freedom. He’s a significant graduate out-of management of the united states Sky Force Academy and you may made his MBA while the a nationwide Prize Scholar from the Spears School from Company in the Oklahoma Condition School.

Due to the fact an armed forces experienced, You will find made it my life’s objective to help individuals real time happy and you can wealthier lifestyle. Section Credit provides so it goal to life. We think in the stability, sincerity, and you may visibility, for this reason , you will see our pricing close to the webpages. You’ll find straight down prices and you may no lending costs, so that you can acquire your perfect home for less. The new coupons are died for you – the way it is.